The rapid growth of the China industrial robot market is one of the most significant shifts in global manufacturing today. Over the past decade, China has transitioned from being primarily a labor-intensive manufacturing hub to becoming the world’s largest consumer of china industrial robot. This shift isn’t simply about embracing new technology—it’s a strategic response to rising labor costs, an aging workforce, and increasing demands for production efficiency and quality control.

What makes China’s approach different is the speed and scale at which this transformation is happening. With strong government support, expanding local robot manufacturers, and the integration of smart technologies like AI and 5G, China is reshaping not only its domestic production lines but also influencing global supply chains. This is no longer an emerging trend—it’s an industrial overhaul that’s already impacting millions of businesses and workers.

Understanding the key drivers, trends, and challenges behind this growth is essential for anyone involved in manufacturing, technology, or investment.

China Industrial Robot Market Growth Explained with Key Drivers and Trends

In this guide, we will explain the core reasons behind China’s industrial robot expansion, the forces driving its momentum, and what it means for the future of automation.

The Rise of the Machines—Made in China

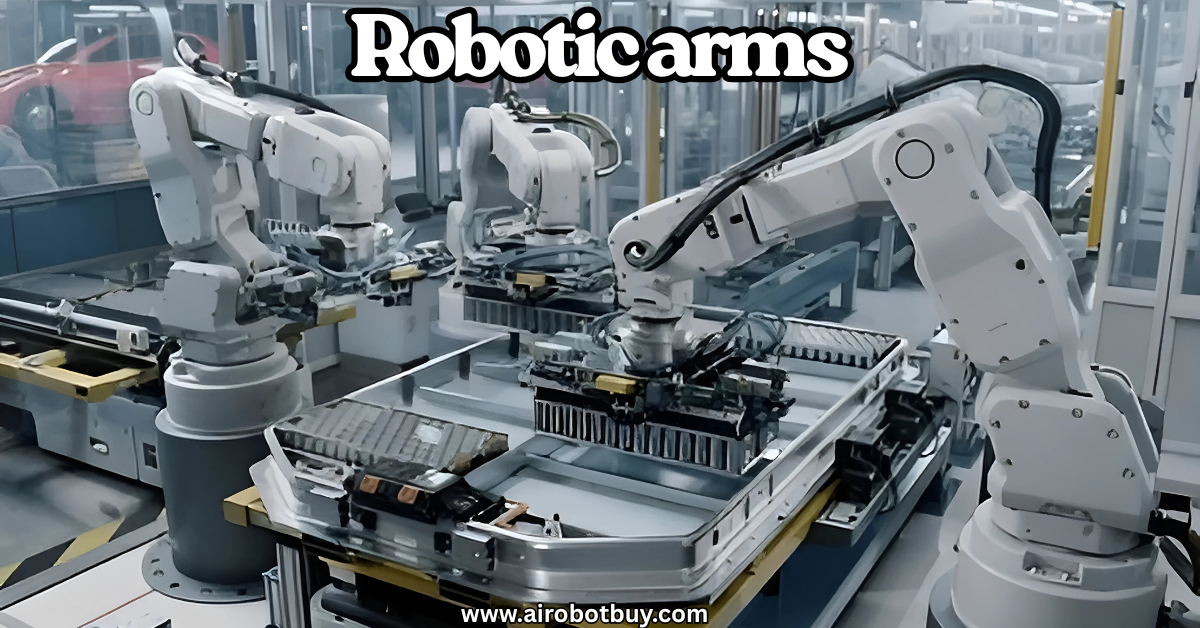

The transformation of the China industrial robot market is not just a phase—it’s a major industrial shift. Over the past 15 years, China moved from being a low-cost labor-driven manufacturing hub to a highly automated, robotics-focused economy. This rise came in response to internal pressures and global competition. Factories that once relied on thousands of workers are now installing robotic arms, smart automation lines, and AI-integrated machines at record speeds.

China surpassed other major economies by volume of industrial robot installations starting around 2013. By 2023, it accounted for over 50% of global installations. This rapid transition is not just about machines—it’s about staying competitive, reducing reliance on manual labor, and producing consistent, high-quality products at scale. Visit here!

Problem: Why China Had to Automate—Fast

Several problems pushed China toward automation and heavy robotics adoption. Here are the main reasons the china industrial robot market had to grow rapidly:

Key issues:

- Labor Shortage: China’s working-age population started to decline after 2015, limiting the supply of skilled labor in factories.

- Rising Wages: Average manufacturing wages grew more than 5x from 2005 to 2020, eating into profit margins and making labor-intensive production unsustainable.

- Quality Standards: Global clients began demanding higher product consistency and traceability, something manual labor couldn’t deliver consistently.

- Export Pressures: Trade frictions, especially with the U.S., pressured local factories to increase self-reliance and efficiency.

- COVID Disruptions: Pandemic-related restrictions made labor availability unpredictable, further accelerating automation.

Solution: Industrial Robots as a National Priority

The china industrial robot market didn’t grow on its own. It was heavily influenced by national policies and industrial strategies.

Key government actions:

- Made in China 2025: This national strategy identified china industrial robot as a core priority. The goal was to upgrade traditional industries through automation.

- Tax and Subsidy Programs: Provinces offered tax credits and subsidies to manufacturers that deployed robots in their production lines.

- Training Programs: Technical schools were directed to expand automation and robotics-related training.

- Smart Manufacturing Parks: Industrial zones specializing in robotics and automation tech were built in cities like Suzhou, Guangzhou, and Shenzhen.

This top-down support gave manufacturers clear direction—and funding—to automate quickly.

Key Drivers Behind China’s Industrial Robot Growth

China’s market leadership in china industrial robot can be traced to several internal and external drivers. These drivers are not temporary—they reflect structural changes in the economy and production environment.

Massive Manufacturing Scale

China still leads the world in manufacturing output. Even small gains in robot use translate into large national figures.

Robot Density Growth

In 2015, China had 49 robots per 10,000 manufacturing workers. By 2023, this grew to 322. This rapid increase shows how serious manufacturers are about robotics.

Local Brands Rising

Chinese companies like Estun and Siasun are increasing their market share and reducing dependency on global suppliers like ABB and FANUC.

Affordability and Efficiency

With more domestic production, robot prices are decreasing. This opens the market to small and mid-sized manufacturers, not just automotive giants.

Trend Breakdown: What’s Shaping the Future of China’s Industrial Robots?

Let’s explore the trends that are shaping how the china industrial robot market will evolve in the next 3–5 years.

Trend 1: Collaborative Robots (Cobots)

- Cobots work safely next to humans.

- Ideal for small production lines and light assembly.

- Growing 30% YoY in China.

Trend 2: Vertical-Specific Robots

- Companies now build robots tailored for specific industries like textiles, packaging, or electronics.

- This reduces integration costs and boosts productivity.

Trend 3: Localization of Core Parts

- China now produces servo motors, reducers, and controllers locally.

- This reduces production costs and supply chain delays.

Trend 4: Robot-as-a-Service (RaaS)

- Factories lease robots instead of buying them.

- Flexible plans based on production hours or output volume.

- Ideal for SMEs with limited capital.

Data Snapshot: What the Numbers Say

The table below shows how the china industrial robot market has grown by key metrics over the past decade:

| Metric | 2013 | 2018 | 2023 |

|---|---|---|---|

| Annual Installations (units) | 36,560 | 154,000 | 290,000 |

| Robot Density (robots/10,000) | 25 | 140 | 322 |

| Share of Local Robot Brands (%) | 15% | 30% | 42% |

| Market Size (USD) | $2.1B | $6.7B | $14.9B |

| Cobot Market Share (%) | 1% | 5% | 14% |

(Source: IFR, CRIA, Ministry of Industry and Information Technology)

These figures show consistent upward momentum across all key indicators.

The Real Impact: What’s Happening on the Ground?

The china industrial robot market is producing real, visible outcomes in thousands of factories across the country.

Common use cases seen today:

- Automotive: Welding and painting robots reduce production time and defects.

- Electronics: High-speed robots for soldering, screwing, and circuit board inspection.

- Metals and Machinery: Robots for laser cutting, CNC loading/unloading, and polishing.

- Food and Beverage: Packaging and palletizing robots improve hygiene and output rates.

- Apparel: Robots are used for fabric cutting and button stitching in major textile hubs.

Even outside the industrial sector, warehouse automation and delivery robots are now being deployed widely.

Challenges Ahead

Despite the rapid growth, the china industrial robot sector faces several obstacles that could affect its trajectory.

Key challenges:

- Skilled Labor Shortage

- Not enough trained workers to install, program, and maintain industrial robots.

- This limits adoption outside Tier 1 cities.

- Price-Based Competition

- Many local robot makers undercut each other to win deals.

- This reduces R&D investment and product innovation.

- Component Bottlenecks

- Despite progress, some critical components like precision sensors are still reliant on imports.

- This affects quality and supply stability.

- Global Expansion Limits

- Chinese robot brands still hold under 10% of the global market.

- Certification, service networks, and brand perception remain weak outside Asia.

What This Means for You

Whether you’re a factory manager, investor, or supply chain professional, the rise of the china industrial robot market affects your strategy.

For Manufacturers:

- Consider upgrading manual stations to robotics if labor costs are rising.

- Apply for regional subsidies to reduce automation costs.

- Evaluate leasing options (RaaS) to avoid large upfront costs.

For Investors:

- Look at upstream companies producing controllers, vision systems, and software.

- Track emerging domestic brands that could grow internationally.

For Tech Startups:

- Develop plug-and-play solutions that fit with China’s major ERP and MES systems.

- Partner with manufacturers in smart industrial parks for pilot testing.

Q&A: Common Questions on China Industrial Robot Market

Q1: Why is China the largest industrial robot market?

A: China’s massive manufacturing base, rising wages, government subsidies, and global demand for higher quality products made automation essential.

Q2: Are local Chinese robot brands competitive?

A: Yes. While global giants still lead in technology, domestic brands are closing the gap in speed, cost, and customization—especially for local industries.

Q3: Which sectors are adopting robots the fastest in China?

A: Automotive, electronics, logistics, and machinery are leading. However, food, apparel, and consumer goods are catching up with cobots and small-scale automation.

Q4: What is the biggest constraint in scaling adoption?

A: Skilled labor for programming and maintenance, followed by lack of integration standards across factories.

Conclusion

The growth of the China industrial robot market is not a short-term trend—it’s a long-term structural shift that’s changing the face of manufacturing. What began as a response to rising wages and labor shortages has now become a national priority, supported by government policies, technological innovation, and expanding domestic capabilities. China is not just using more robots; it is building a complete industrial ecosystem around robotics, from component manufacturing to AI integration.

With increasing robot density, wider adoption across industries, and the rise of local brands, China has positioned itself as a global leader in automation. The challenges—such as skill gaps and global competitiveness—are real but are being actively addressed through investment in training, infrastructure, and research.

For businesses, investors, and policymakers, the rise of china industrial robot in China presents both opportunities and disruptions. Understanding this landscape is essential to stay relevant and competitive in the evolving global economy.

The direction is clear: automation is no longer optional in China’s industrial future—it’s the new standard.